Introduction to Conversational AI in Banking

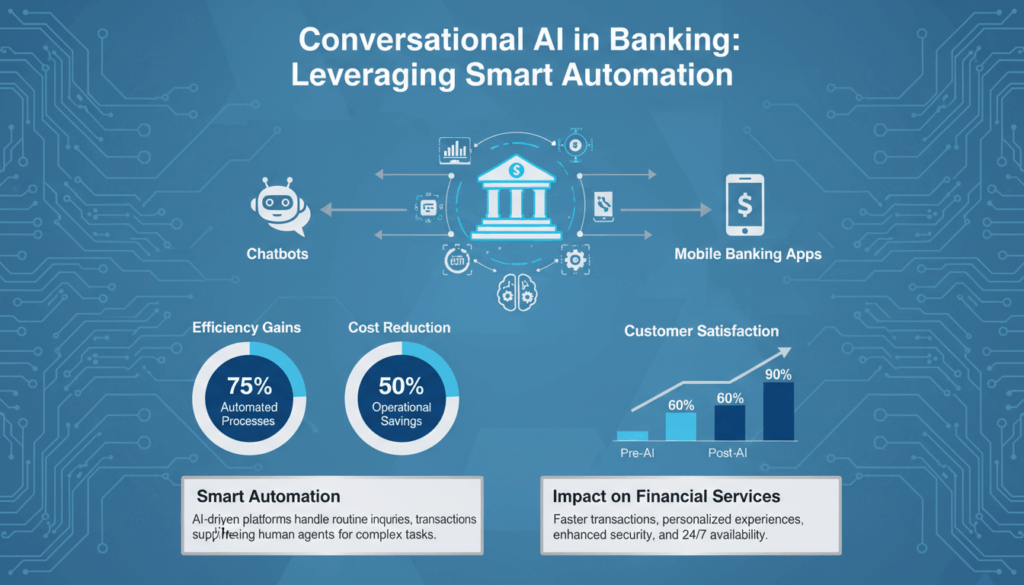

Conversational AI is transforming the banking industry by reshaping how financial institutions interact with their customers. At its core, conversational AI refers to the suite of technologies that enable machines to communicate with people using natural language. This involves the integration of various sophisticated tools like chatbots, virtual assistants, and voice recognition systems, all of which are designed to mimic human interactions in a seamless and efficient manner.

In the banking sector, the adoption of conversational AI is predominantly driven by the need to enhance customer service while optimizing operational efficiency. Customers today demand faster, more personalized services without the inconvenience of traditional banking hours. Conversational AI addresses this need by providing 24/7 support, thereby extending service capabilities beyond the confines of human operatives.

One of the most evident applications in conversational AI is the deployment of chatbots on banking websites and apps. These chatbots can handle routine inquiries such as balance checks, transaction histories, and fraud alerts. For instance, if a customer wants to know their account balance late at night, a chatbot can quickly provide this information without human intervention, significantly reducing wait times and improving customer satisfaction.

Virtual assistants, which are a more advanced iteration of chatbots, offer personalized financial advice by understanding and interpreting customer behavior and preferences. This capability is powered by machine learning algorithms that analyze transactional data to offer insights such as budgeting advice, savings suggestions, and investment opportunities. An example of this is Bank of America’s virtual assistant, Erica, which not only performs basic banking functions but also proactively suggests ways for users to save money based on their financial habits.

Voice banking is another innovative realm where conversational AI is making strides. By utilizing advanced speech recognition systems, customers can perform complex banking tasks through voice commands. This technology is particularly beneficial for those with visual impairments or individuals who prefer hands-free operations, thus promoting inclusivity within banking services.

Beyond customer-facing applications, conversational AI is also transforming backend processes. Natural Language Processing (NLP) algorithms are deployed to streamline documentation, conduct sentiment analysis on customer feedback, and automate routine tasks, thus freeing up human resources for more value-added activities.

Despite its myriad advantages, implementing conversational AI in banking does come with challenges. Concerns about data security and privacy are paramount, given the sensitive nature of financial information. As a result, banks must rigorously adhere to regulatory standards and employ robust encryption methods to protect customer data.

Overall, conversational AI presents a significant opportunity for banks to revolutionize the customer experience, improve efficiency, and drive innovation. It requires thoughtful integration with existing systems, a commitment to data privacy, and continuous improvement to adapt to changing customer needs and technological advancements.

Key Components of Conversational AI Systems

Conversational AI systems in banking are fundamentally constructed from a range of technologies that work in harmony to facilitate seamless interaction between machines and humans. Each component plays a critical role in ensuring that the system responds accurately and efficiently to user inputs while maintaining a natural conversational flow.

At the heart of these systems is Natural Language Processing (NLP). NLP is responsible for understanding and processing human language, enabling machines to comprehend, interpret, and respond to text or voice inputs. This involves several sub-processes such as tokenization, where sentences are broken down into words or phrases, and syntactic analysis, which examines grammatical structures. Semantic analysis further allows the system to grasp the meaning and context of sentences, making interactions more effective and less robotic.

A significant aspect of conversational AI is Machine Learning (ML), which provides the system with the ability to learn and evolve from interactions. Over time, ML algorithms analyze user inputs and feedback to improve the accuracy and relevancy of responses. For example, when a customer frequently asks about “savings plans,” the AI learns to prioritize relevant financial advice. This adaptability is crucial for providing personalized experiences and enhancing customer satisfaction.

Speech Recognition technology is a vital component, especially for systems requiring voice interface capabilities. Using advanced algorithms, speech recognition converts spoken language into text that AI can process. It involves complex acoustic modeling and language processing techniques to ensure accurate transcription despite variations in accents, speech patterns, or ambient noise. This component is particularly important in banking, as it facilitates hands-free operations, making services more accessible.

Another foundational part is Dialog Management. This technology orchestrates the conversation flow, determining what the system should say or do next based on user input and predefined logic. This component ensures the interaction remains coherent, even when users deviate from expected dialog paths. A well-designed dialog management system can anticipate user needs by leveraging past interactions, providing smoother and more contextual engagements.

Integration APIs play a critical role in connecting conversational AI systems with a bank’s existing infrastructure. APIs enable the seamless exchange of data between the AI system and core banking systems, facilitating real-time account management, transaction processing, and secure information retrieval. This integration is essential for maintaining a seamless user experience, allowing customers to execute tasks such as balance inquiries or fund transfers quickly and securely.

Finally, Security Protocols are integral due to the sensitive nature of financial data. Robust encryption and authentication mechanisms ensure that user data is protected at all stages of interaction. Compliance with regulations such as GDPR or CCPA is mandatory to safeguard privacy and build trust among users. These protocols include multi-factor authentication, which adds layers of security to user verification processes.

Each of these components must work cohesively to create an intelligent conversational AI system capable of transforming banking services. By combining advanced technologies and robust security measures, banks can provide users with efficient, personalized, and secure interactions, ultimately driving customer engagement and satisfaction.

Implementing Conversational AI for Customer Support

Implementing a conversational AI system for customer support within a banking environment requires a multifaceted approach that combines the latest advancements in artificial intelligence with existing service frameworks. The goal is to enhance user interaction while maintaining security and compliance with regulations.

The first step involves identifying specific customer support needs that can be addressed using conversational AI. For banks, these needs typically include handling common inquiries, executing transactions, providing personalized advice, and resolving basic issues that traditionally consume a significant amount of human resources. By analyzing customer interaction data, banks can pinpoint frequent requests and queries amenable to automation.

Once the needs are clearly defined, banks can proceed with the selection of an appropriate AI platform. An ideal platform should offer robust NLP capabilities, seamless integration with existing systems through APIs, and support multiple communication channels like chat, voice, and even email. Vendors such as Google Dialogflow, Microsoft Bot Framework, and IBM Watson offer customizable solutions tailored to banking applications.

Designing the conversational flow is crucial to ensure that customer interactions are intuitive and efficient. This involves creating a dialog tree that anticipates user inputs and provides relevant responses. Employ domain experts and UX designers to craft interactions that guide users towards quick resolution without frustration. Tools that allow for A/B testing and iterative improvements can significantly enhance this process.

Integrating the AI system with a bank’s existing infrastructure requires robust APIs that ensure secure and smooth data interchange. Secure data handling is paramount. The AI system should have the capability to access customer account details, recent transactions, and other necessary data, all while adhering to strict privacy standards, such as encryption in transit and storage.

Setting up a feedback loop is crucial for ongoing improvement. Incorporating mechanisms for customers to provide feedback on the AI interactions can provide valuable insights into performance. This feedback should be harnessed to refine responses, expand conversational abilities, and adapt to new types of customer queries. Machine learning models need to be continuously trained using this data to improve their accuracy and empathetic responses.

To maintain high levels of trust, implementing robust security protocols is essential. Multi-factor authentication (MFA) should be enforced for sensitive operations, and strict access controls must be in place to prevent unauthorized data access. Regular security audits and compliance checks with standards such as GDPR and CCPA will further bolster trust in the system.

Finally, staff training and customer education are vital to the success of conversational AI. Customer service teams should be trained on how the AI system functions, its capabilities, and how to handle escalations effectively. Simultaneously, banks must educate customers about the features and benefits of using AI-powered chatbots and virtual assistants, providing assurances around data privacy and security.

By adopting these strategies, banks can create a conversational AI system that is not only efficient and responsive but also secure and capable of delivering a personalized customer experience. This will lead to increased customer satisfaction, reduced operational costs, and a stronger competitive position in the financial sector.

Enhancing Security and Compliance with AI

Security and compliance are fundamental concerns in the banking industry, especially as financial institutions increasingly integrate AI technologies into their operations. The dynamic nature of AI offers advanced solutions to address these challenges effectively, ensuring that customer data is both protected and handled in accordance with relevant regulations.

AI can automate and enhance numerous security protocols in banking. For instance, machine learning algorithms are pivotal in real-time threat detection. These algorithms can monitor and analyze transaction patterns to identify unusual activities that might indicate fraud. By leveraging a combination of supervised and unsupervised learning models, anomalies can be detected earlier than traditional systems, thereby minimizing the impact of security breaches.

Another key security enhancement facilitated by AI is advanced biometric authentication. AI-driven biometrics, such as facial recognition, voiceprints, and fingerprint scanning, provide robust user verification that is difficult to replicate using traditional methods. These technologies use deep learning models to ensure a high level of accuracy and can be continuously improved as new data is acquired, bolstering security measures.

In terms of compliance, AI systems assist banks in adhering to evolving regulatory landscapes. Natural Language Processing (NLP) capabilities allow for the automatic parsing and analysis of legal documents and regulatory changes. AI algorithms can be trained to flag non-compliant transactions by cross-referencing them with existing regulatory frameworks. This automation reduces the burden on compliance officers and increases the speed and accuracy of regulatory adherence.

AI also improves the efficiency of Know Your Customer (KYC) processes, which are critical for both security and compliance. Traditionally a labor-intensive procedure, AI can expedite KYC by instantly verifying customer identities through automated document verification processes. AI systems can cross-reference data points from multiple sources to validate customer identity quickly, reducing the chance for human error and enhancing the overall reliability of KYC.

Ensuring that AI systems themselves are secure is equally crucial. Developing and implementing AI technologies that are transparent and auditable is essential to maintain trust and reliability. Explainable AI (XAI) approaches can provide insights into decision-making processes, ensuring that actions taken by AI systems are interpretable and comply with regulatory standards. Employing blockchain technology in tandem with AI can also enhance security and compliance. Blockchain provides a transparent and immutable ledger system, which safeguards against data tampering and ensures traceability for audit purposes.

Moreover, integrating AI with robust cybersecurity frameworks ensures that any data processed by AI technologies is shielded from external threats. This includes employing techniques such as encryption and secure multi-party computation, which protect data at all stages — whether in motion or at rest. Implementing regular security assessments and updates is essential to identify vulnerabilities in AI systems and adequately address them before exploitation can occur.

Training and upgrading team capabilities are vital components of maintaining security and compliance standards in an AI-driven environment. Continuous education around the latest security technologies and regulatory changes will ensure that banking professionals are prepared to leverage AI effectively while safeguarding sensitive information. Overall, by strategically implementing AI technologies, banks can significantly enhance their security and compliance frameworks, thereby securing customer trust and ensuring sustained operational integrity.

Measuring Success: KPIs and Performance Metrics

In the ever-evolving landscape of banking, leveraging Conversational AI not only transforms customer interaction but also necessitates effective measurement of its success. To determine the impact and efficiency of conversational AI implementations, financial institutions must deploy well-defined Key Performance Indicators (KPIs) and performance metrics. These metrics serve as a compass to guide strategic decisions and align the deployment of conversational AI with overarching business goals.

Using KPIs to measure success involves establishing clear objectives for AI implementation. For instance, objectives might include reducing customer service costs, increasing customer satisfaction, or enhancing user engagement. To evaluate these objectives, banks can monitor several key metrics:

Firstly, Customer Engagement Metrics are vital for assessing how users interact with AI systems. This can include the number of users actively engaging with chatbots or virtual assistants, the frequency of use, and the duration of each session. Tracking these metrics helps identify patterns such as peak usage times, which can guide staffing and system upgrades to improve service availability.

Resolution Rate is another critical KPI, reflecting the percentage of customer queries effectively handled by the AI system without requiring human intervention. A high resolution rate signifies that the AI is capable of resolving common queries, thereby reducing the burden on human customer service representatives. This metric also highlights areas where the AI might need further training or adjustments to improve accuracy.

The effectiveness of AI in improving customer satisfaction can be quantified using Customer Satisfaction Scores (CSAT). This involves soliciting feedback through surveys post-interaction with the AI system, asking customers to rate their experience. High CSAT scores generally indicate that the AI is meeting user expectations in terms of responsiveness and ease of use.

Cost Reduction Metrics are also indispensable, especially concerning operational efficiency. By comparing the costs associated with AI-driven interactions against traditional customer service methods, banks can assess cost savings. Metrics such as reduction in employee workload and decrease in average handling time directly correlate with reduced operational expenses, showcasing AI’s economic advantage.

Furthermore, Error Rate Tracking provides insights into potential improvement areas. It involves measuring how often the AI system fails to provide accurate or relevant responses. By analyzing errors, banks can fine-tune algorithms and update AI databases to better align with customer needs and evolving banking trends.

On the backend, System Performance Metrics play a role in ensuring the AI’s technical robustness. This includes monitoring system uptime and response times. Any latency issues or downtimes can negatively affect customer service and engagement, therefore maintaining optimal system performance is paramount.

Security and Compliance Metrics ensure that AI implementations do not compromise banking standards. Regular audits and tracking of security incidents can help maintain customer trust. Metrics such as the number of identified potential security threats or the frequency of system penetration tests serve as indicators of a robust security posture.

Lastly, it’s essential to incorporate Continuous Improvement Metrics, which assess how well the AI system learns and adapts over time. Monitoring changes in AI adaptability and intelligence through machine learning improvements can demonstrate the system’s growth and evolving capabilities.

In conclusion, the deployment of conversational AI in banking is most successful when paired with strategic measurement through KPIs and performance metrics. These metrics not only provide insights into the efficacy of AI tools but also guide future improvements and innovations, ensuring that banks can consistently deliver exemplary customer service within a secure and efficient operational framework.